The phone rings. Your hard-charging client says, “I sit on the board of trustees of a charity that…” What follows sounds like Charlie Brown’s teacher. “Whaa-whaa-whaa.” Here we go. He or she is a) moving money out, thereby cutting your fees or b) asking your firm to buy a $25,000 table at the annual fundraiser.

If you are worried about losing assets, my advice is prospect harder. Your business doesn’t have critical mass if you equate client philanthropy with loss of income.

Invariably, the client would turn up the heat. “My other adviser took a table. Personally.”

“Yeah, well, send me more assets, and I will write a check too.” No, I didn’t really say that. But you know where I am coming from.

Fortunately, most of my charity discussions were about something different. They began with a deeply personal question. The client would ask, “How can I prevent my kids from thinking they are entitled to luxury cars on their sixteenth birthdays?”

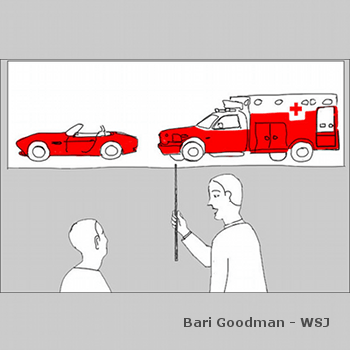

Bari Goodman

That was my cue to describe family foundations, and how they can make philanthropy a family value and avert the me-me-me mind-set.

“When your family starts talking about charitable causes,” I would say, “your kids will find the BMW talk unattractively self-centered.”

That said, my thoughts are evolving. Giving away money may actually be the wrong skill to teach kids, who have never struggled to make ends meet.

To gain perspective, I asked a question of several people who play different roles in wealth management: “How should financial advisers discuss philanthropy with their clients?”

Charlotte Beyer founded the Institute for Private Investors, where she served as the chief executive for 21 years. She is the author of “Wealth Management Unwrapped” and president of the Principle Quest Foundation, which supports financial education and mentoring programs for women.

Start with the basics, Ms. Beyer said. Ask, “What is this wealth intended to be?”

Once you ask them this question, it might be easier to identify those who feel like they would like to start donating to non-profits and charities. You can then start introducing them to a charity of a cause of their choice, and with the help of business tools (like the one you can find at https://www.upmetrics.com/solutions-investors.html), show them how easy it is to donate in today’s technological age.

Many wealth creators struggle to understand the meaning of their money, specifically whether they should use it for “freedom, power, fun,” or something else, she explained. If a client has charitable instincts, those values will bubble up to the surface

I like her approach. It forces clients to identify what is important. It saves you from guessing whether a family foundation is the right tool.

Next, I spoke with Ellen Israelson. She is the vice president of marketing and business development for the Jewish Communal Fund, a donor-advised fund based in Manhattan.

Ms. Israelson stressed the importance of advisers talking to their clients about philanthropy and being comfortable with the conversation. The great majority of households make charitable donations, she noted, “anywhere from eighty-six to ninety percent.”

When I asked whether giving away money is the wrong skill to teach kids, Ms. Israelson made a great point. “Philanthropy can be an excellent training ground.” She explained, “It starts the wealth conversations in an area that’s comfortable.”

Her observation resonated with me. I am aware of several situations where the parents fear the how-much-money-do-we-have conversation and, therefore, avoid the topic of family finances with their children. Not good.

By this time, I wanted input from a financial adviser. So I spoke with Niall J. Gannon, head of the Gannon Group in St. Louis and author of “Investing Strategies for the High-Net-Worth Investor.”

“Building a new park or fountain,” he said, “or putting your name on a building doesn’t make you a better guy.”

The observation caught me by surprise, especially because Mr. Gannon and his brother recently built a medical clinic in Kenya.

“What do you mean?” I asked.

Click here to continue reading on the WSJ.

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.