It’s time for the client’s annual portfolio review–and time to take market share, the advisers think.

They know the client, a wealthy family, spreads its assets around the Street. And their firm’s results have been exceptional this year. So they bring out the spiral-bound pitch books. They load up the PowerPoint slides. Then one after another, with confidence and steely-eyed gravitas, they extol their investment performance on the overhead projector.

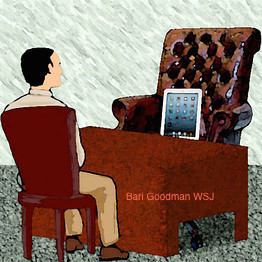

As the meeting ends, a member of the family says, “Our other adviser made its presentation on iPads.”

Thud.

April Rudin, founder and CEO of the Rudin Group, tells this story to illustrate the growing importance of technology in all forms of client interaction. With the Dow hovering near its all-time high, money is in motion. And wealth-management business models are under siege.

Slick mobile apps, “robo-advisers”–and who knows what’s next. Who will win, and who will lose the technological arms race of wealth management?

Ms. Rudin says, “There’s no excuse, even compliance, for falling behind.”

The stakes couldn’t be higher. Consider this item from the Capgemini and RBC Wealth Management’s 2014 World Wealth Report: Two thirds of high-net-worth investors “are likely to leave firms that do not allow them to transact digitally.”

The report defines “transact” as 1) “executing transactions” [meaning buys and sells] and 2) “transferring money between accounts.”

This strikes me as a big uh-oh for registered investment advisers that lack brokerage capabilities. Sure, it’s nice to pitch transparency and conflict-free advice. Doing the right thing is every bit as important today as it was when the financial markets crashed in 2008. But if clients want to “transact” online, it’s probably time for pure RIAs to add capabilities.

To be fair, Capgemini’s conclusions are broad in scope. They focus on what clients expect from wealth-management technology rather than the competitive advantages of one business model versus another.

The company writes, for example, that HNW investors “prioritize digital interactions that keep them informed and that enable transactions, but favor direct interactions (i.e., in-person, phone) to engage with firms for advice.”

At least face-to-face interactions are here to stay.

I approached several of the report’s contributors and asked, “How can financial advisers best compete, given the technological changes in wealth management?”

Mr. Wilson, head of Capgemini’s strategic analysis group, boiled the firm’s advice down to three words: “understand, lobby, test.”

By “understand,” he means listen. What do your clients want? “Lobby” means demand the functionality you need. The old squeaky-wheel trick. And “test” means experience your firm’s products the way your clients experience them. Get your hands dirty.

It’s one thing to say, another to do. Bill Sullivan, who leads financial services market intelligence at Capgemini, says that U.S. advisers, particularly those in their 50s and 60s, are sometimes reluctant to embrace firm technology.

Then there’s the training issue. Referring to my firm’s technological capabilities, a boss once told me, “You need to learn this [expletive].” That was the extent of my curriculum. I was on my own.

To continue reading, click here to go to the WSJ…

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.