“I’ve saved my clients millions in estate taxes,” the financial adviser said.

Over a few rounds of Christmas cheer, we were discussing the many ways traditional advisers help their clients. For the most part, we focused on estate planning (similar to that provided by Essayli & Brown and other firms): grantor retained annuity trusts, dynasty trusts, family foundations or the benefits of paying tuition for grandkids.

These techniques not only cut taxes. They also increase client trust in advisers and divert discussions away from the tougher issues of wealth management. Like fees. Like investment performance against an index. Like paltry syndicate allocations in hot new IPOs.

Estate-planning expertise is great if your average client is worth $10.86 million or more, which is next year’s threshold for inheritance taxes kicking in.

But what if estate-planning tools don’t apply to your practice?

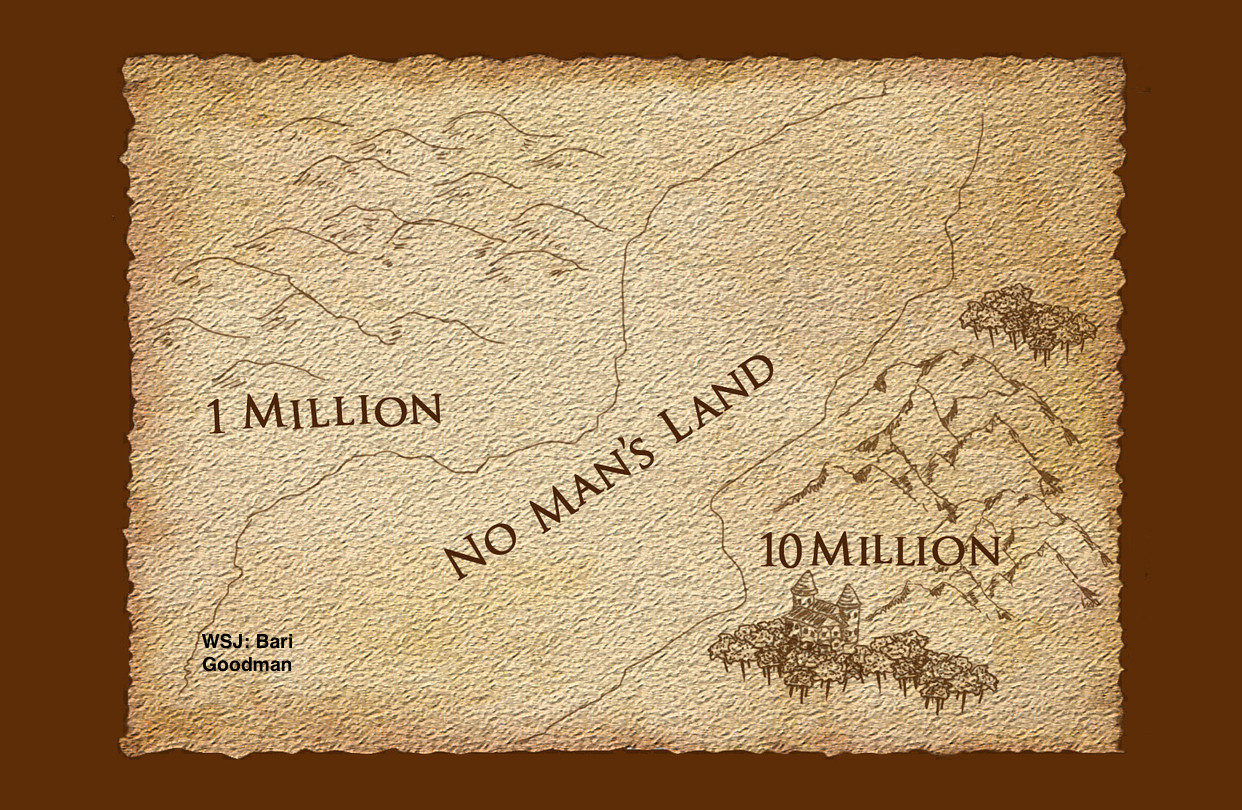

Financial advisers, who target clients worth $1 million to $10 million, face brutal competition urging many advisers to search for financial services marketing options to stand out from the rest. Exchange-traded funds often charge less than 10 basis points. And in the wake of 2008-2009, many clients are questioning whether they are better off with do-it-yourself or robo-advised portfolios.

This market niche, $10 million or less, might well be the no man’s land of private wealth management. You’ll never be able to say, “I saved you millions in estate taxes,” because they simply don’t apply to couples in this bracket. And it is harder to identify those pockets of expertise where you can make a profound impact on the financial health of your clients.

But they’re out there.

John Voltaggio, a financial adviser from Northern Trust, recently briefed me on postnuptials agreements. Even though he focuses on clients with more than $10 million in assets, it quickly became apparent that “postnups” have broader appeal given the right set of circumstances.

They can be particularly useful, Mr. Voltaggio explains, when both spouses have kids from previous marriages. In these situations, the spouses might prefer to leave assets to their children rather than each other.

Postnups “complement an estate plan,” says Mr. Voltaggio. Spouses can acknowledge each other’s final wishes and say, “I’m okay with it.” This kind of unanimity is hugely valuable whether a couple has $1 million or $100 million.

The alternative could be a messy lawsuit. It is easy to imagine a scenario where one spouse, already grieving over the death of the other, is absolutely shattered to learn that he or she has been cut out of the will.

Good morning, Counselor. Goodbye, family savings.

The power of a postnup, from the adviser’s point of view, is two-fold. You sound smart, seasoned. You are advising your client to get out in front of a potential problem for the kids.

More importantly, you build trust. There is nothing like bringing an idea to a family, one where you will never get paid but one that shows you are focused on their unique circumstances.

That is why wealth management is a business of tomorrows. Financial advisers provide services today with the hope, but no absolute certainty, that a little ka-ching will follow tomorrow.

Of course not every tomorrow is rosy. In his practice, Mr. Voltaggio emphasizes the use of postnups for couples with healthy relationships. What if a marriage is on the rocks?

To continue reading, click on the Wall Street Journal.

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.