If you listen carefully, if you pause and remain very still and tilt your head at just the right angle, you might notice the calm before the storm of clients moving assets.

Skittish markets, robo advisers and fiduciary regulations are sure to put money in motion over the next 12 to 24 months as clients react to industry changes and make decisions about their wealth.

That’s opportunity.

I believe scrappy advisers—who anticipate client needs, think independently from their firms, and fly into the turbulence with thoughtful strategic plans—will take market share.

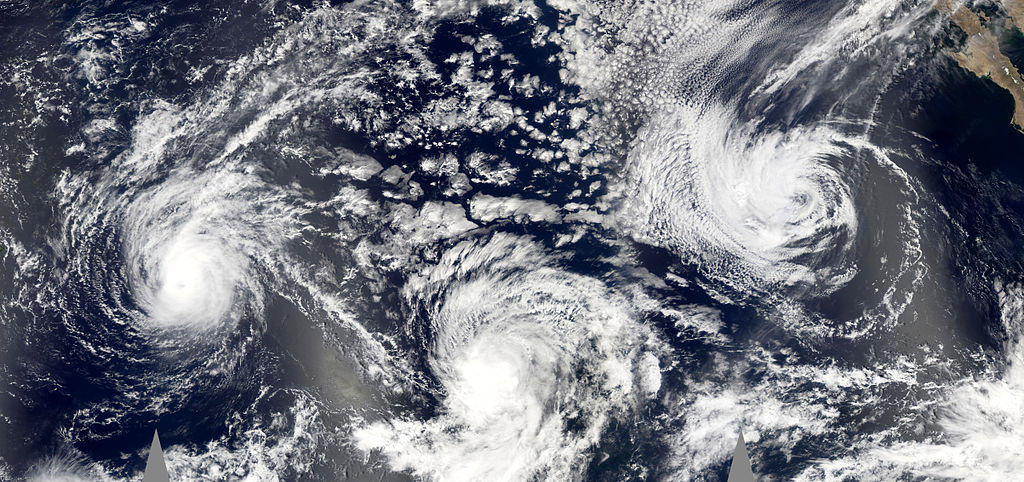

Market turbulence

Let’s start with skittish markets. The Dow Jones Industrial Average closed down 588 points on August 24. In the days that followed, the trading reminded me of the 3:30 p.m. derbies from 2008, when the Dow could swing 500 points either way in the final 30 minutes before the closing bell.

Investors are worried, right? China’s economy is slowing. Some central banks are saying the S-word, “stimulus,” even as the Federal Reserve is threatening to raise interest rates. And some of the old tools that dampen volatility and smooth portfolio returns don’t feel especially reliable.

To continue reading on the Wall Street Journal click here.

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.

The New York Times describes my novels as “money porn,” “a red-hot franchise,” and “glittery thrillers about fiscal malfeasance.” Through fiction I explore the dark side of money and the motivations of those who have it, want more, and will steamroll anybody who gets in their way.